Europe Artificial Intelligence (AI) in Retail Market Size, Share, Trends, & Growth Forecast Report Segmented By Technology (Machine Learning, Natural Language Processing, Swarm Intelligence, Chatbots, and Image & Video Analytics), Sales Channel, Component, Application, Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic & Rest of Europe) Industry Analysis From 2024 to 2033

European Artificial Intelligence (AI) in Retail Market Size

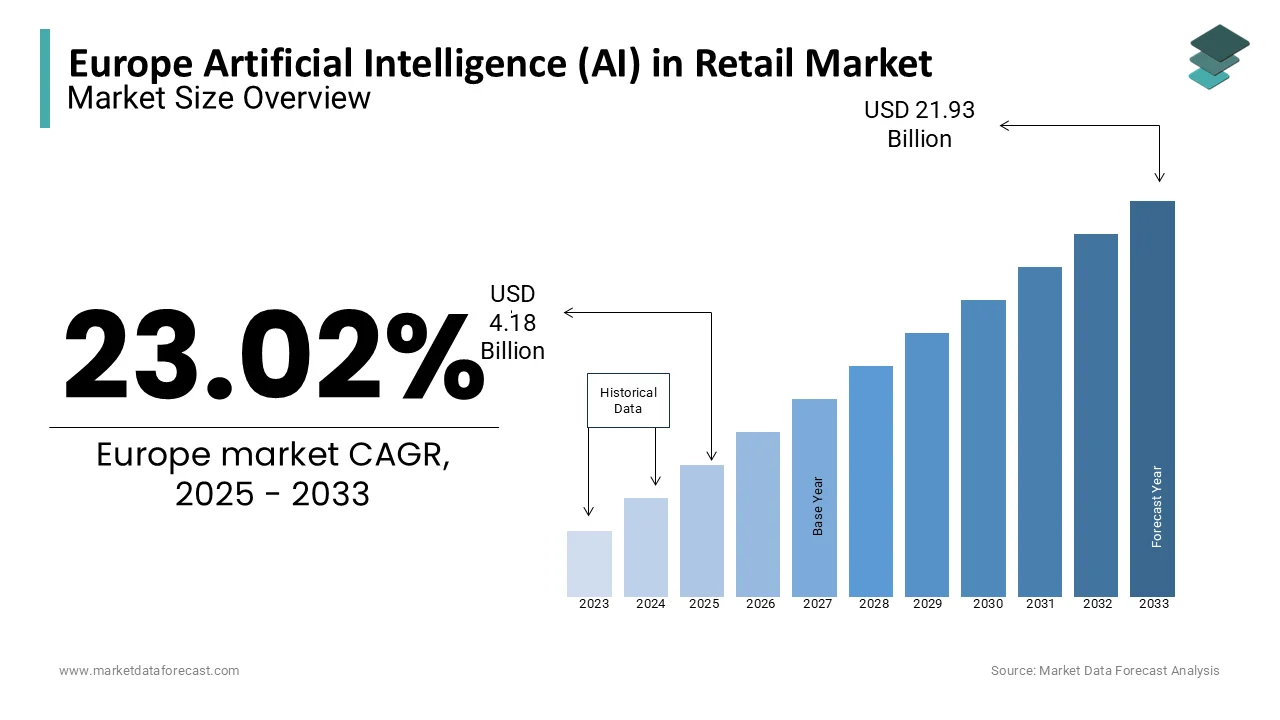

The European artificial intelligence (AI) in retail market was valued at USD 3.40 billion in 2024. The European market is projected to reach USD 21.93 billion by 2033 from USD 4.18 billion in 2025, growing at a CAGR of 23.02% from 2025 to 2033.

The European Commission emphasizes the importance of AI in driving the digital transformation of the retail sector to align with the Digital Strategy of the EU. According to the European Parliament, AI adoption in the EU retail sector grew by 25% annually during the foreseen period. Major applications include AI-driven chatbots that handle over 70% of customer inquiries in leading retail companies, and recommendation engines that boost online sales conversion rates by up to 30%. Germany, France, and the UK are at the forefront of AI adoption in retail in Europe owing to the availability of advanced digital infrastructure and robust e-commerce ecosystems.

MARKET DRIVERS

Rising Consumer Demand for Personalization

The growing consumer preference for personalized shopping experiences is a significant driver of the European artificial intelligence in retail market. AI enables retailers to analyze vast amounts of customer data to deliver tailored recommendations, offers, and product suggestions. The European Commission highlights that personalization can increase customer engagement by 40%, enhancing loyalty and repeat purchases. AI-powered recommendation engines are widely used in e-commerce, boosting conversion rates by up to 30%. Countries like the UK and Germany, with advanced e-commerce ecosystems, are leveraging AI to refine customer experiences. This focus on customization aligns with changing consumer expectations, driving further adoption of AI tools in the retail sector.

Digital Transformation and Automation Initiatives

Digital transformation efforts across Europe are significantly accelerating AI adoption in retail. The European Union’s Digital Decade Strategy aims for 75% of businesses to integrate digital technologies, including AI, by 2030. Retailers are increasingly using AI to automate repetitive tasks, such as inventory management, pricing optimization, and demand forecasting. According to the European Commission, AI-driven inventory systems can reduce stock shortages by 20%, improving operational efficiency. France and Italy are actively investing in AI automation to enhance supply chain resilience and streamline retail operations. These initiatives align with the broader goal of enhancing efficiency and competitiveness in the European retail industry.

MARKET RESTRAINTS

High Implementation Costs

The significant cost of deploying AI technologies is a major restraint for the European artificial intelligence in retail market. The European Commission reports that integrating AI solutions, such as machine learning algorithms, data analytics platforms, and robotics, often requires substantial investment in infrastructure, software, and skilled personnel. For small and medium-sized enterprises (SMEs), which make up over 99% of EU businesses, these costs can be prohibitive. Additionally, maintenance and upgrades for AI systems add to the financial burden, making it challenging for smaller retailers to adopt AI technologies. This cost barrier slows the pace of AI integration, particularly in emerging markets within Europe.

Data Privacy and Regulatory Challenges

Stringent data privacy regulations, such as the General Data Protection Regulation (GDPR), present challenges for AI adoption in Europe’s retail sector. Retailers rely on vast amounts of customer data to power AI-driven personalization and analytics, but GDPR compliance requires robust data protection measures, increasing operational complexity. The European Data Protection Board emphasizes that non-compliance can result in fines of up to €20 million or 4% of global turnover, deterring some businesses from fully leveraging AI. Moreover, navigating regulatory frameworks across different EU member states adds complexity for multinational retailers, further restraining the widespread adoption of AI technologies in retail.

MARKET OPPORTUNITIES

Integration of AI in Sustainable Retail Practices

The incorporation of AI into sustainable retail practices offers a significant growth opportunity in the European market. AI-powered tools can optimize inventory management, reducing overstocking and waste, which aligns with the European Union’s Circular Economy Action Plan. According to the European Commission, efficient inventory systems using AI can decrease surplus inventory by 30%, leading to reduced environmental impact. Retailers are also utilizing AI to analyze supply chain data and ensure compliance with sustainability standards, such as carbon footprint reduction. Countries like Germany and Sweden are leading this transition, integrating AI to meet consumer demand for eco-friendly products and sustainable business practices.

Expansion of AI-Driven Omnichannel Retail

The rise of AI-driven omnichannel retailing is another major opportunity for the European market. AI enhances customer experiences by integrating data across online and offline platforms, enabling seamless transitions between shopping channels. The European Commission highlights that 60% of European consumers expect a unified shopping experience, and AI tools such as virtual assistants and chatbots are critical in meeting these expectations. The adoption of AI technologies has been particularly strong in the UK and France, where retailers are leveraging tools to enhance real-time inventory tracking and personalized recommendations. This trend positions omnichannel retail as a key growth driver, allowing retailers to capture a larger customer base and increase revenue.

MARKET CHALLENGES

Shortage of Skilled Workforce

The shortage of skilled professionals in AI development and implementation poses a significant challenge for the European artificial intelligence in retail market. According to the European Commission, 65% of businesses in Europe face difficulties hiring AI specialists due to a lack of trained personnel. This skills gap affects the ability of retailers to adopt and optimize AI solutions, particularly in areas such as machine learning, data analytics, and AI-driven customer experience management. Countries like Italy and Spain, which have lower rates of AI expertise compared to the EU average, are particularly impacted. The limited availability of skilled workers delays the deployment of AI technologies and increases the cost of acquiring external expertise.

Integration Complexity with Legacy Systems

Integrating AI solutions with existing legacy systems presents a significant technical challenge for the European retail sector. Many retailers still rely on outdated IT infrastructure that is incompatible with advanced AI technologies, resulting in operational inefficiencies. The European Commission highlights that 35% of businesses report integration issues as a key barrier to adopting AI. Upgrading legacy systems requires significant investment and time, making it difficult for retailers to achieve a seamless transition. This is particularly challenging for small and medium-sized enterprises (SMEs), which lack the financial and technical resources to overhaul their IT frameworks, hindering the widespread adoption of AI solutions.

REGIONAL ANALYSIS

The United Kingdom is dominating the artificial intelligence in retail market in Europe and this trend is anticipated to continue throughout the forecast period in this regional market due to the advanced digital infrastructure and strong e-commerce ecosystem. According to the UK Department for Digital, Culture, Media & Sport, the country invests heavily in AI research, with over £1 billion allocated to AI innovation programs since 2020. The UK’s robust retail sector, featuring major players like Tesco and ASOS, utilizes AI for personalized marketing, inventory management, and chatbot-driven customer service. This adoption positions the UK as a leader in leveraging AI technologies to enhance operational efficiency and customer engagement.

Germany is likely to showcase promising in the Europe AI in retail market over the forecast period owing to the strong industrial base and commitment to digital transformation. The Federal Ministry for Economic Affairs and Climate Action highlights that Germany invests significantly in AI-driven retail automation, such as inventory tracking and predictive analytics. Retailers like Zalando employ AI to refine product recommendations, achieving a 30% increase in sales conversions. Germany’s focus on sustainability also integrates AI tools to optimize supply chains and reduce waste, aligning with EU environmental goals.

France is estimated to account for a notable share of the European AI retail market during the forecast period. The government-backed initiatives like the National AI Strategy that allocates €1.5 billion to AI development are favouring the French market growth. According to the French Ministry for the Economy, AI adoption in retail focuses on enhancing omnichannel experiences and customer personalization. Companies like Carrefour lead in implementing AI-powered tools, driving innovation and reinforcing France’s role as a key market player.

KEY MARKET PLAYERS

Intel Corporation, Salesforce.com, Inc., NVIDIA Corporation, Amazon Web Services, Inc. (Amazon.com, Inc.), Google LLC, IBM Corporation, Microsoft Corporation, Oracle Corporation, SAP SE, and ViSenze Pte Ltd are leading players in the European artificial intelligence (AI) in retail market

MARKET SEGMENTATION

This research report on the European artificial intelligence (AI) in retail market is segmented and sub-segmented into the following categories.

By Technology

- Machine Learning

- Natural Language Processing

- Swarm Intelligence

- Chatbots

- Image & Video Analytics

By Sales Channel

- Omnichannel

- Pure-play Online Retailers

- Brick & Mortar

By Component

- Solution

- Services

By Application

- Customer Relationship Management (CRM)

- Supply Chain & Logistics

- Inventory Management

- In-Store Navigation

- Payment & Pricing Analytics

- Product Optimization

- Virtual Assistant

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Frequently Asked Questions

What types of AI technologies are widely used in the retail market?

AI technologies such as computer vision, natural language processing, machine learning, and robotics are commonly used in retail for tasks like product recommendations, chatbots, and automated checkouts.

What is driving the adoption of AI in the retail sector in Europe?

The key drivers include the need for better customer engagement, increased operational efficiency, and the growing demand for data-driven insights to improve decision-making.

How is AI used in inventory management in retail?

AI-powered tools assist in demand prediction, real-time stock monitoring, and automating restocking processes, ensuring optimal inventory levels and reducing waste.

What is the future outlook for AI in the European retail market?

The market is expected to see growth with advancements in AI technologies, wider adoption by both large and small retailers, and increasing focus on sustainable and automated retail operations.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com